In late April, weeks after Covid-19 had already deeply scarred Japan, Prime Minister Shinzo Abe announced that his government would make a one-time ¥100,000 cash payment to every resident of Japan to alleviate some of the economic pressure caused by the spread of the virus. The initiative was the most significant among Abe’s previously proposed relief plans, which included the distribution of two washable cloth masks per household, discounts for high-quality meat and a ¥300,000 subsidy to individuals whose income had halved due to the pandemic.

Luckily, it didn’t take too long before Prime Minister Abe realized that the coronavirus had already robbed too many residents of their regular income. Fast forward to the end of May, the majority of Japan’s 47 prefectures and municipalities are now getting ready to deliver the stimulus payment to residents. The following is a step-by-step guide on how and when to claim yours.

- Are you eligible to receive the stimulus payment?

- How can I claim the money?

- When can I apply?

- Applying online

- Paper application form

- When will I receive the money?

- What if I don’t need the money?

- Who should I contact for more information?

Are you eligible to receive the stimulus payment?

If you are a registered resident in Japan as of April 27, 2020, then yes, you are eligible to receive the payout. All foreign residents who have a legal residence card are eligible to receive the government’s subsidy.

How can I claim the money?

There are two ways. You can either wait for the paper application form, which will be sent to your home address by the local city hall, or apply online.

When can I apply?

If you choose to apply online, you can start immediately as long as your municipality has already started accepting online applications. You can check if that’s the case here (the daily updates are in Japanese, but you will most likely be able to spot the name of your prefecture and town).

If you’re waiting for the application form to arrive, then apply as soon as you receive it. You should send your application back to your local municipality within three months of the receipt.

Applying online

You can apply online via the My Number Portal Site. The website is only in Japanese, but you can use an auto-translate plugin on your browser to navigate the platform. Before you begin filling in the application form, make sure that you have all of the following at hand:

- Your My Number Card (not the notification card but the actual plastic card)

- A card reader to attach to your PC or a smartphone that can scan your My Number Card

- Your My Number Card PIN (a combination of 6 to 16 letters and digits)

- Download the Myna Portal app and add it as an extension to your browser

If you have everything listed above ready, then you’re ready to start. The video below, released by the government, is only in Japanese but it provides an overview of where to click as you proceed. If you watch it before you apply and then use an auto-translate on the actual website, it is doable provided that you have all the necessary documents and gadgets listed above.

Paper application form

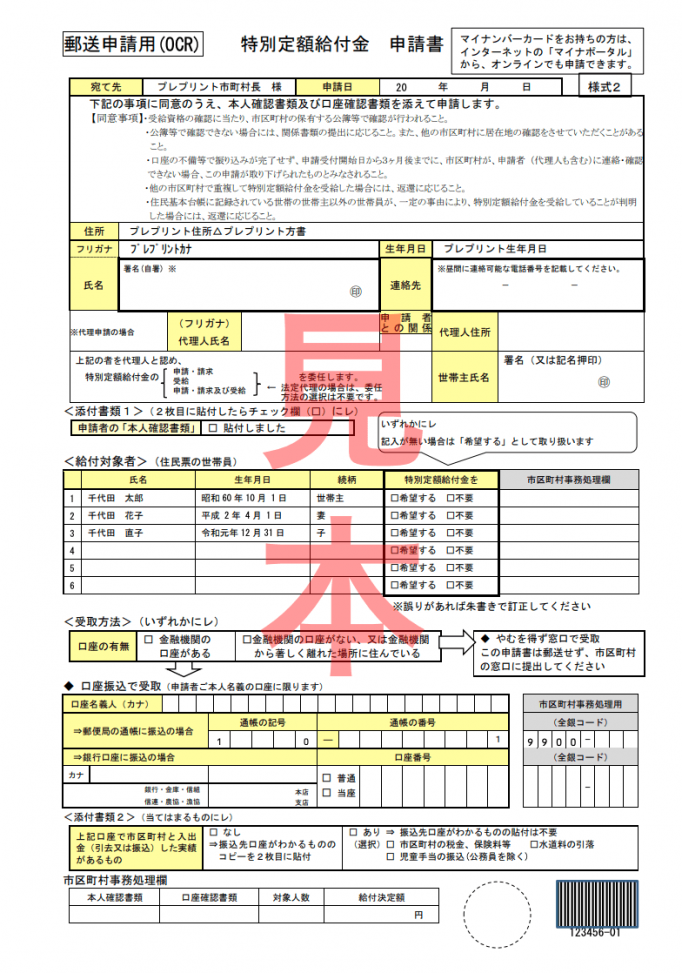

If you don’t have a My Number Card, a card reader or you’ve forgotten your PIN, then you have no other options but wait for your paper application to arrive. Local municipal government offices have started or will soon begin sending out the paper application forms. The forms will be addressed to the head of every household in Japan (if you live alone, you are the head of the household). Check whether your local government has started sending out the forms here.

To receive the ¥100,000, you will have to fill in the application form and send it back. You will not receive the money automatically. The form pictured below is the latest sample provided by the government.

While the actual application form may slightly differ according to municipalities, it will not be too different from this sample. The government has not provided any information on whether the application form will include instructions in English, but even if it doesn’t, use the following tips to fill it in (see details for each section below).

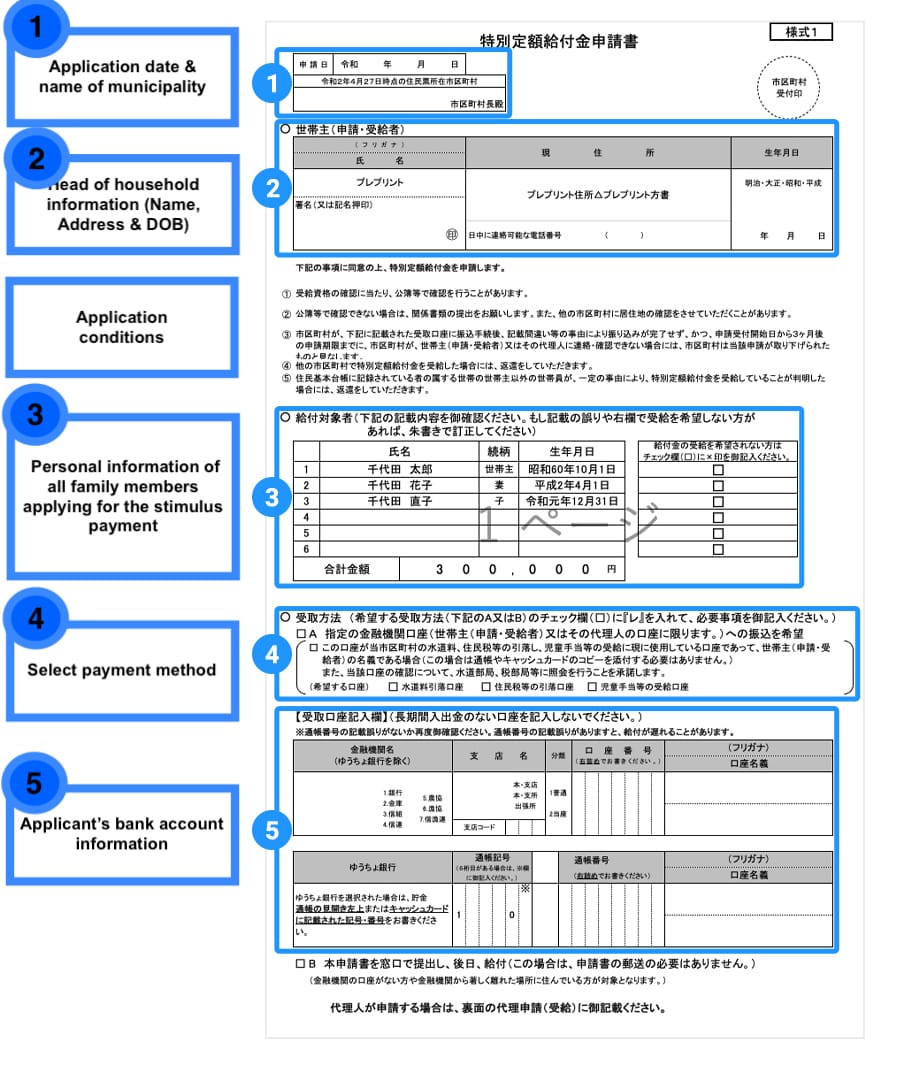

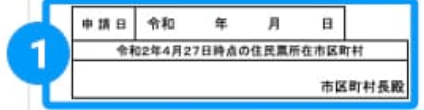

Section 1

In Section 1, fill in the application date starting from the year (令和) 2, followed by the month (月) and the day. If you are filling in the application on May 27, 2020, it will look like 令和2年5月27日. In the space below write the name of the municipality in which you live as of April 27.

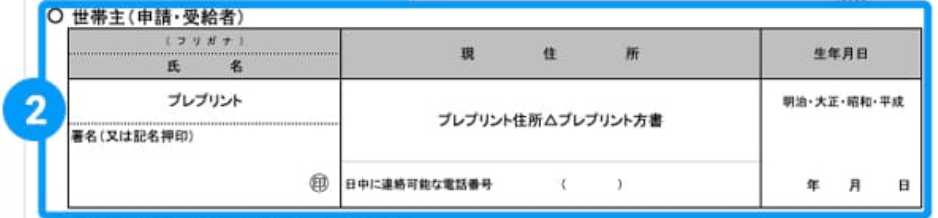

Section 2

Section 2 is all about the applicant’s (head of household) personal information. Under 氏名 write your full name as it appears on your residence card. Above your name, in the place where it says フリガナ, also write your name in furigana (the katakana pronunciation of your name). If your name is already printed out in the application form, write it once again in the 著名 field. Stamp the 印 circle with your hanko if you have one. If you don’t have one, put your official signature in the same circle. Under 現住所 write your current address if it’s not printed already. Below that, in the 日中に連絡可能な電話番号 field, write your telephone number. Next, write your date of birth in the 生年月日 field. If you’re born on May 7, 1985, it should look like this: 1985年5月7日. Above that, you will find the name of the past four eras, from Meiji (明治), Taisho (大正), Showa (昭和) and Heisei (平成). Put a circle around the era when your birthday falls in.

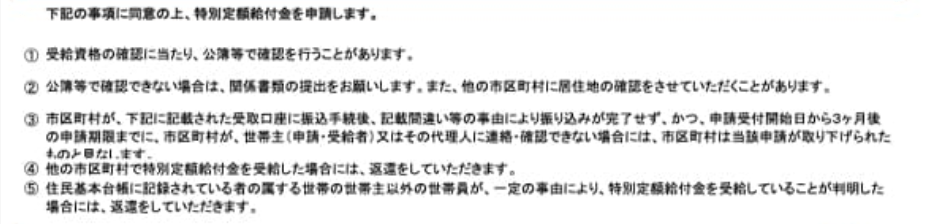

Under this section, you will find disclaimers and application conditions. It basically tells you that you agree to apply for the stimulus payment under the following conditions:

(1) The local government may check public records to ensure that you’re eligible to receive the stimulus payment.

(2) If the local government cannot confirm your eligibility based on existing records, you may be required to submit additional documents. It may also contact other municipalities to enquire about you.

(3) If the municipal government is unable to complete the bank transfers to your bank account (or to the proxy’s in the application) due to mistakes in the application form and if the municipality cannot reach the applicant (or proxy) for clarity within three months of the receipt of the application, the application will be considered as withdrawn.

(4) If you receive the payment from another municipality, you must return it.

(5) If any family members listed in the application have received the payment from another municipality, you have to return it.

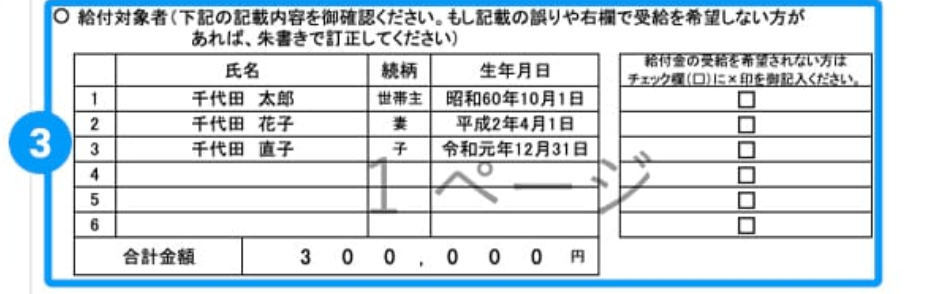

Section 3

In Section 3 list all family members living with you who are also eligible to receive the payment (in other words, who are also registered residents as of April 27, 2020). Write their full names under 氏名. Next to this, under 続柄, write their familial relationship to you. If you’re listing your child’s name, write 子 (ko). If it’s your wife/husband’s name, write 妻 (tsuma)/夫 (otto). Next to this, write each person’s date of birth in the same manner you wrote yours. In 合計金額 write the total sum you expect to receive (each gets ¥100,000, so if you’re a family of four, it will be ¥400,000).

The block next to this is very tricky. It tells you to put a cross next to the name of the person who doesn’t want to receive the stimulus payment. If you want everyone in the family to receive it, leave this part blank.

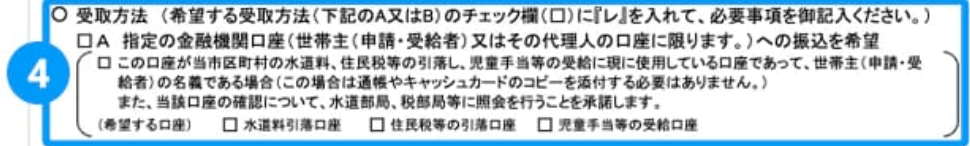

Section 4

In Section 4, specify your preferred method of receiving the payment. If you want the payment deposited into your bank account, check box “A.” Check Box “B” (way below) if you want to collect the money in person. Please note, however, that the government discourages this to avoid a further spread of the virus. You should collect the money in person only under special circumstances, such as not having a bank account or other personal issues.

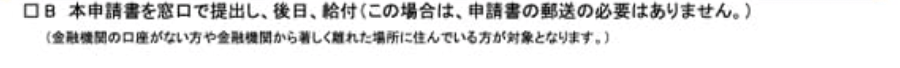

Section 5

In Section 5 write your bank account details. Under 金融機関名, write the name of your bank and circle 1 for “bank.” Next, under 支店名, write the branch. In 支店コード write the branch code. Next, under 分類, choose 1 for regular account and 2 for saving account. In the field next to this, write your bank account number. Next to it, write the account holder as it appears on your cash card or bank book. The field under this is for account holders at Japan Post Bank (Yucho Ginko).

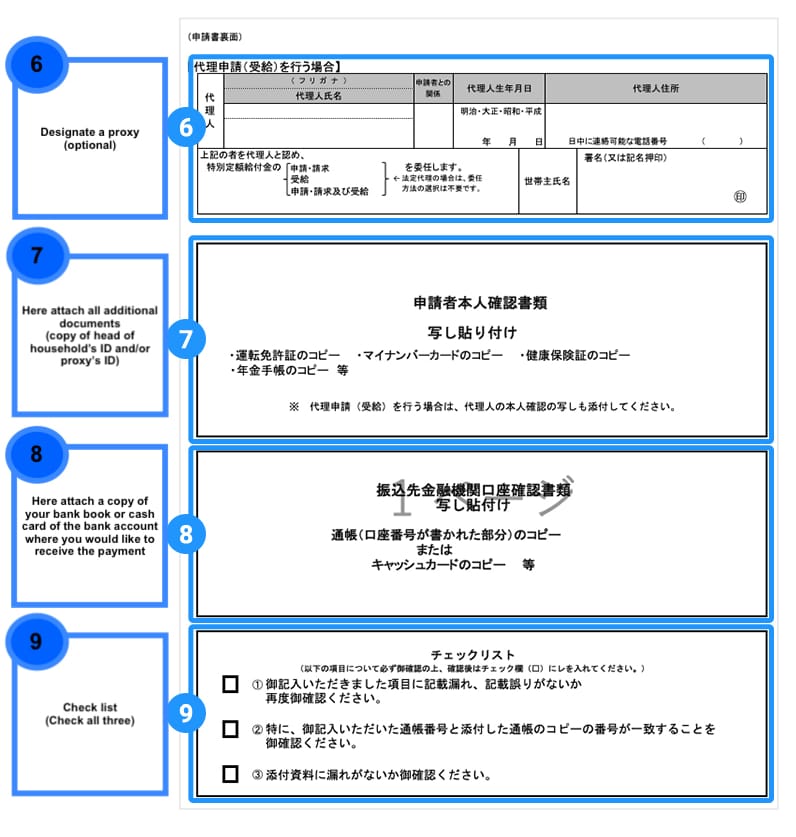

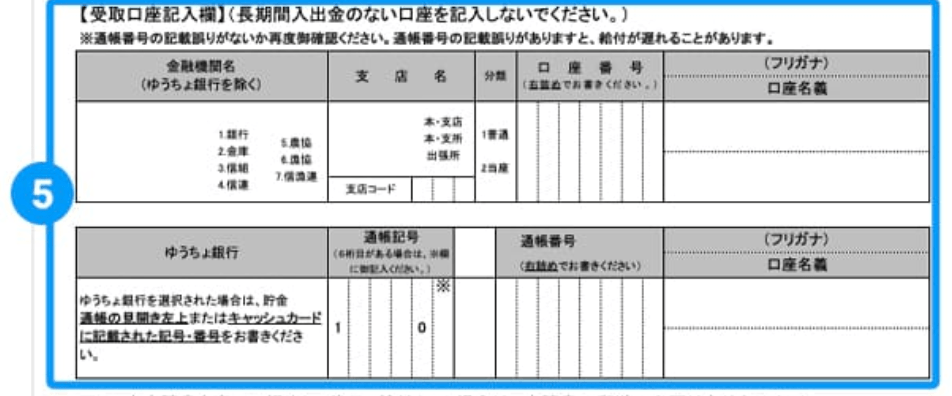

Section 6

Fill in Section 6 on the next page if you want to designate a proxy. Write the full name of your proxy, followed by his/her relation to you, their date of birth, address and telephone number. In the field below that, circle what you allow them to manage on your behalf: apply (申請・請求), receive (支給) or apply and receive (申請・請求及び支給) the payment. In the field next to that, write your name and stamp your hanko or your signature.

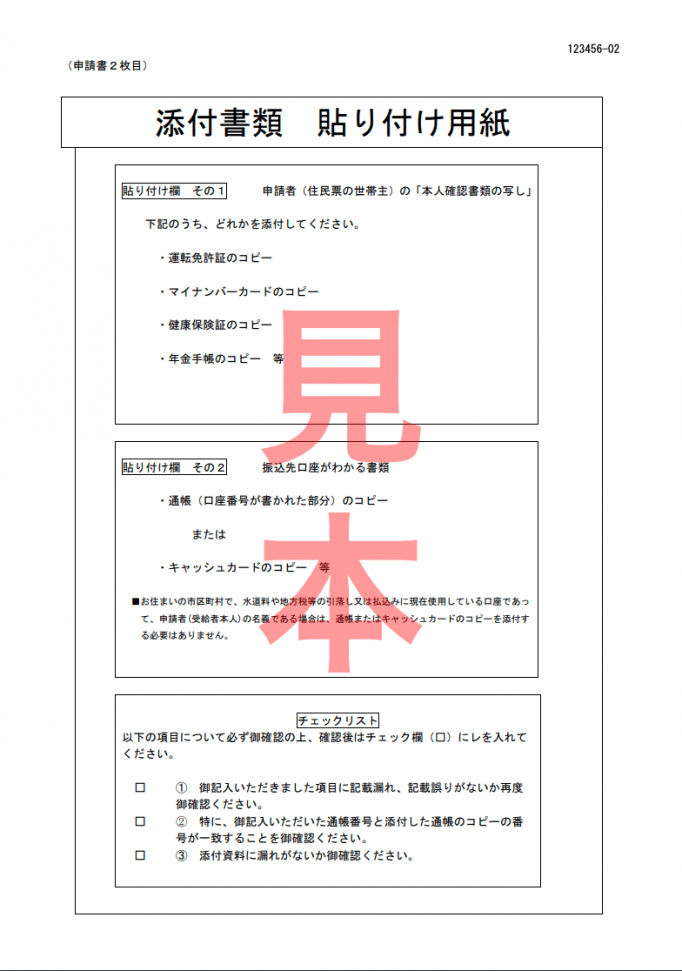

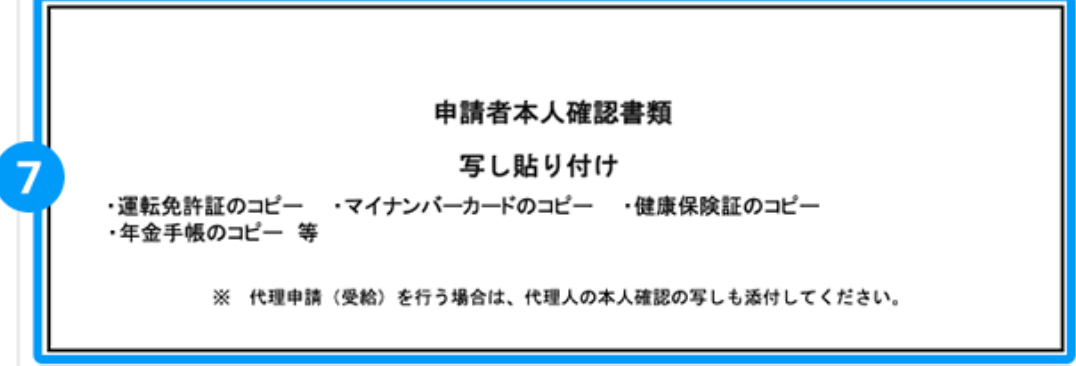

Section 7

Here is where you should attach all additional documents. Those include a copy of an official ID of the head of household and/or your proxy. Either of the following documents will be sufficient: residence card (copy both sides), passport copy, driver’s license, Japanese health insurance card, or My Number Card.

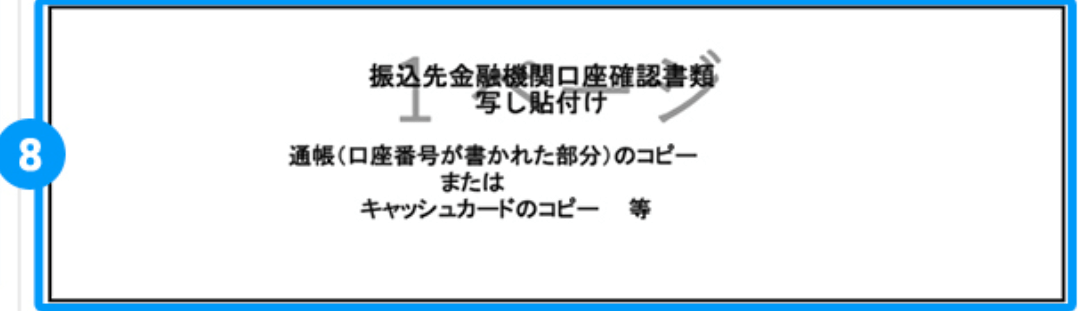

Section 8

Here, attach a copy of your bank book or cash card.

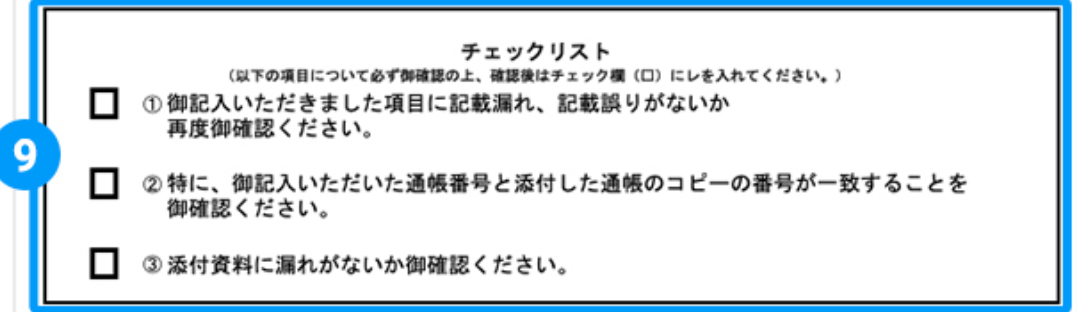

Section 9

This is a checklist. Check all three listed there. It says the following:

- Check once again if all blanks are filled in accordingly and there is no missing information.

- Make sure that the bank information you have written in the application and the copy of the bank book/cash card are of the same bank account.

- Check whether all additional documents have been properly attached.

For further assistance, this video guides you through the application filling process, step by step.

After you’ve filled in the application form, mail it back to your local government office using the enclosed pre-paid return envelope.

When will I receive the money?

This depends on each municipality. However, for most prefectures, it shouldn’t be later than July. Just make sure you send your application as soon as possible.

What if I don’t need the money?

You can donate to charities and organizations, give to a friend or relative or someone else in need. Or you can spend it all on local businesses to help them come out of the crisis. Either way, you’ve paid your taxes and you have the right to claim the money from the government.

Who should I contact for more information?

For further inquiries, you can contact the government’s Special Cash Payments Call Center at 0120-260-020 or 03-5638-5855. For more information, see this FAQ PDF provided by the government.

Got any additional questions? Let us know in the comments.