With its recent surge in global popularity, matcha powder is at the top of everyone’s shopping lists. For months, “Japan Haul” videos have been featuring dozens of matcha cans that tourists scored in Kyoto and Tokyo. Self-proclaimed “matcha creators” go as far as to load giant suitcases with every flavor from each famous brand to test them for content. This mass matcha consumerism, however, looks like it’s coming to a screeching halt — extreme demand has led to an unprecedented matcha shortage in Japan.

As winter approaches, matcha drinkers are left with limited access to their beloved warm beverage. In light of the Japanese yen’s lows and subsequent overtourism this past year, this matcha shortage points to a broader issue of overconsumption.

Matcha Demand Continues To Skyrocket

Japanese tea brands stocking matcha powders have all been struggling to meet the enormous demands imposed on their physical and online stores. Many of them have halted sales of matcha products all together. Ippodo and Marukyu Koyamaen have both sold out most of their collections for the first time ever.

Tea Farms at Harvesting Capacity

A primary reason for matcha’s enduring premium status and higher price point is its delicate and time-consuming production process. The best tea leaves are harvested only once a year, within a very limited time frame of less than two months. It is no surprise, then, that matcha in Japan is running out for the year.

The finest tea leaves (“first flush” matcha) were harvested back in April and May, and there was no way for farmers to predict the beverage’s exponential growth in popularity since then. Although lower-grade “second flush” and “third flush” matcha leaves are harvested from June to July and from September to October respectively, they aren’t as popular with brands or customers.

Impact on Japanese Matcha Brands

Since October, companies have attempted to preserve some supplies. Specialty stores in Tokyo and Kyoto have been limiting purchases to one item per person, especially for the most sought-after flavors. On September 5, Ippodo announced a price increase across the board for its matcha products. Marukyu Koyamaen did the same in October and warned customers against placing online orders for resale purposes.

Some establishments abroad are also imposing similar restrictions. Cafés and retailers in Sydney are starting to introduce purchase limits, and, according to The Strait Times, businesses in Singapore have been raising prices on matcha products up to 15% since mid-October.

Why Is Matcha So Popular Abroad?

Matcha-flavored snacks like KitKats have always fascinated tourists in Japan, but the traditional tea beverage has never experienced its current level of sales. Japanese tea exports — including matcha — reached a staggering high of approximately ¥29.2 billion in 2023. That figure is around double the amount recorded in 2019.

Visual Appeal on Instagram

One of the main reasons for the global surge in demand for matcha is, of course, social media. At the height of the Instagram foodie culture in the mid-2010s, desserts and brunch dishes had to be visually stimulating as well as conceptually unique to stand out in a sea of taiyaki ice-creams and rainbow bagels. Restaurants and cafés in major cities could no longer bank on taste or health benefits alone to catch and sustain customers’ attention: food needed to be Instagrammable to garner a following.

In an attempt to ride this wave, an American duo opened Cha Cha Matcha in 2016 in New York City’s Nolita neighborhood, becoming one of the first Western chains to commodify matcha’s aesthetic appeal. With a millennial-pink storefront, palm tree motif and catchy neon signs (“I love You So Matcha”), the café quickly garnered a huge following. Cha Cha is just one example among many western businesses co-opting matcha to this day.

The Rise of Tiktok Aesthetics

The trend of making matcha lattes at home, however, is relatively recent. With the popularity of TikTok during the 2020 pandemic lockdown, crafting interesting beverages such as Korean dalgona (whipped) coffee became a coping mechanism for distress and boredom. Among a plethora of viral pandemic recipes like banana bread and baked feta pasta, matcha continued to shoot up in relevance, especially in the digital landscape. This is largely due to the drink’s association with several TikTok “aesthetics” that package micro-trends and products into aspirational content.

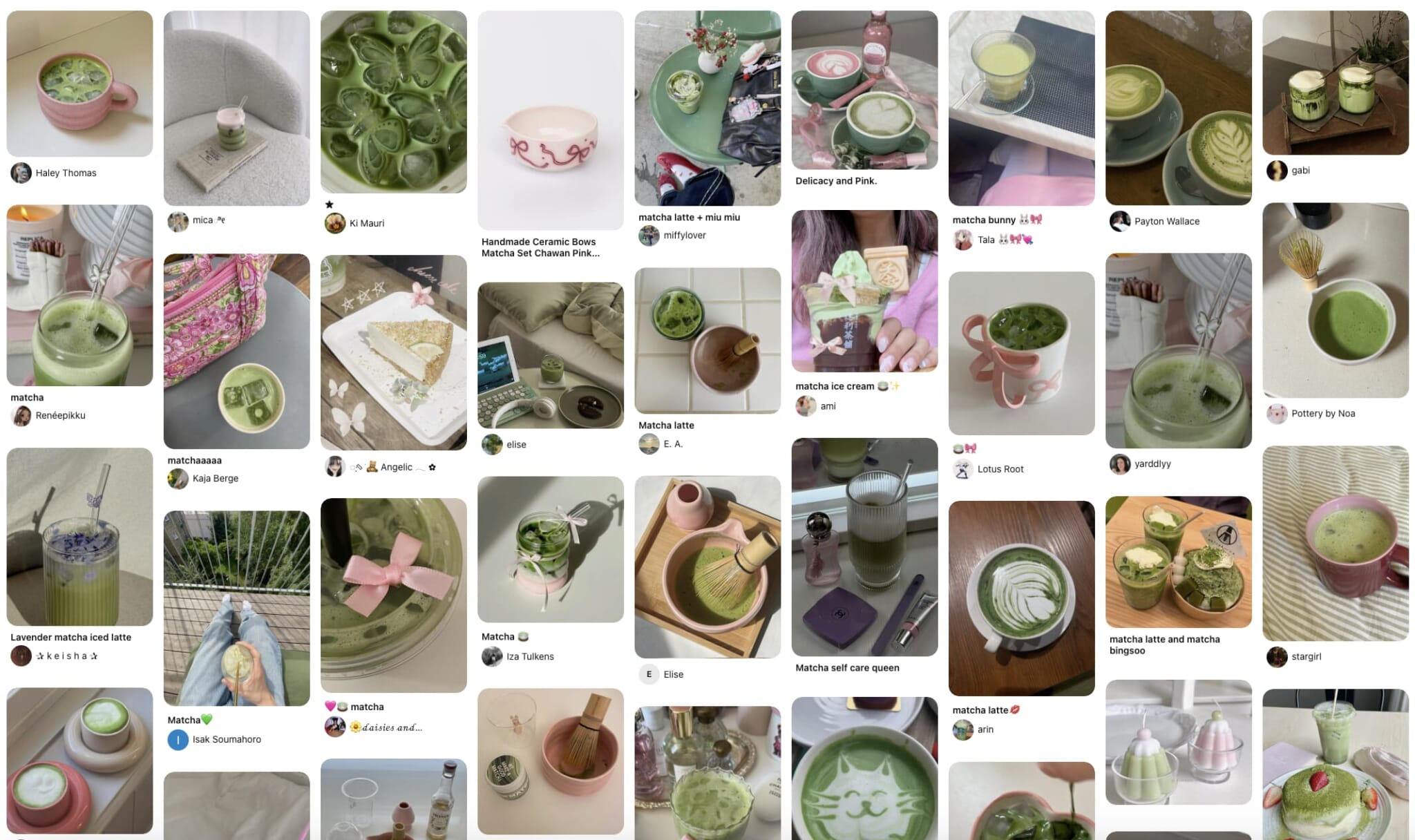

“balletcore matcha” search on pinterest

Clean Girl and Balletcore

In 2022, the “clean girl” aesthetic began to dominate the fashion, beauty and health industries. With their slicked-back buns, 10-step skincare routines and carefully crafted effortless ensemble of Aritzia basics, “clean girls” started their morning ritual with a cup of iced matcha.

Later that year, as the clean girl aesthetic gradually began to oversaturate both digital and physical realms, Gen Z began moving on to “balletcore,” which consisted of hyper-feminine visuals, like ribbons on absolutely everything, Mary Jane shoes and pastel shades. As the obsession with girly brands like Miu Miu and Sandy Liang grew, so did the demand for cute Pinterest-ready matcha beverages in ribbon-patterned mugs.

TikTok’s algorithm ensures that these visual references, encompassing not only fashion and beauty products but also food and household items, seep into your headspace. Because TikTok aesthetics stem largely from individual lifestyle content, integrating a homemade matcha drink into your own routine feels like an innocuous and autonomous choice.

Mindful Consumption and Alternative Sources

It is easy to get swept up in the endless shopping opportunities in Japan, whether you are snatching up a rare Hello Kitty plushie or limited-edition Onitsuka Tiger shoes in Omotesando. However, it’s important to keep in mind that purchasing an excessive number of matcha cans and hoarding them robs other people of their afternoon treats. It also creates an obstacle for tea ceremony practitioners.

As a global phenomenon, matcha is available via sources beyond Japanese shops and online stores. US-based brands, such as Rocky’s Matcha, Chamberlain Coffee, Blue Bottle and Nami Matcha are gaining traction as solid alternatives to Japan-based options.

Rather than frantically acquiring as many tins of matcha as possible during a limited stay in Japan, tourists may have better luck paying slightly more for matcha back home. After all, the ceremonial drink is meant to be enjoyed in small quantities, and has a short shelf life — freezing it may damage the flavor and texture.

It remains to be seen whether matcha brands will experience the same demand after next year’s harvest, but this year’s shortage should encourage enthusiasts to adopt a more mindful and sustainable approach to matcha appreciation.