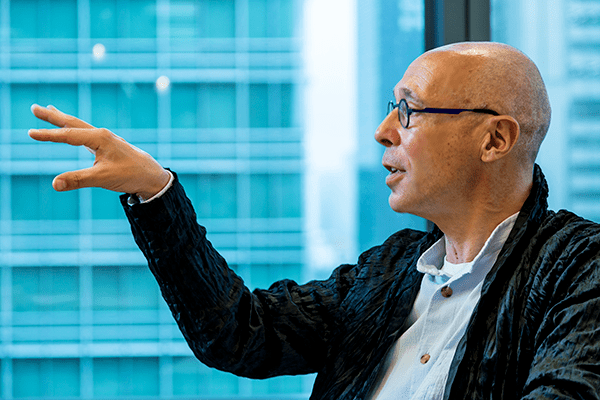

As part of Tokyo Weekender’s year-long 50th anniversary celebration we launch a new series in which we interview experts in various fields about the future of Tokyo. This month we talk with Jesper Koll, one of Japan’s leading economists, to discuss the impact of the global coronavirus pandemic

In mid-April the International Monetary Fund (IMF) reported the economic impact of the Covid-19 pandemic will be worse than the global financial crisis that followed the 2007 Lehman shock. The same report said if containment measures work, and a substantial fiscal stimulus is implemented, the Asian economy can bounce back in 2021.

With uncertainty surrounding Tokyo’s immediate future, we talked to Jesper Koll, one of Japan’s most influential economic experts. The founding CEO for asset manager WisdomTree Japan, Koll was formerly chief strategist and head of research for JPMorgan and Merrill Lynch, and is one of the few non-Japanese members of the Keizai Doyukai, the Japan Association of Corporate Executives.

We wanted to find out if Koll, who recently published his third book in Japanese, Japan’s Economy: The Envy of the World, is still optimistic heading into what IMF says could be the greatest recession since the Great Depression.

What are the economic effects of the pandemic for Tokyo?

First of all, there is obviously a huge amount of uncertainty. This is not the sort of economic shock that we have gone through in the past. If you focus on the previous shocks, like the Lehman shock, or the Asian financial crisis or even the collapse of the Japanese bubble economy, these were shocks where the financial system froze up. As the financial system froze up, the real economy gets forced down. With this shock, it’s the other way around. It’s the real economy that freezes up.

You can’t go shopping, and so on. Then there’s the added complication, which is when you have a shock like an earthquake or a typhoon, it’s terrible because of the loss of life, and the human suffering that is caused, but once it’s over you get to rebuild, which is economic activity. With this shock, what are you going to rebuild? There is nothing that has been destroyed except for jobs.

Some pundits feel PM Abe dragged his feet too long to declare a state of emergency, saying he was putting the economy ahead of health and safety. In your opinion, is this criticism valid?

From an economist’s perspective, I think that Abenomics has always been about … the economy first. Ultimately Abe had no choice in terms of creating this glide path rather than an abrupt change in direction. Abrupt change is not how you would describe Japanese culture and Abe has stayed very true to himself… I think that the competition between Tokyo Governor Yuriko Koike and Prime Minister Abe, when you look at this objectively rather than trying to take sides, this dialectic, where you have the governor of the largest province, Tokyo, openly challenging the authority of the prime minister, that is a good thing…. As long as there is this competition between Koike and Abe, the overall outcome has actually improved.

“Japan is in a good position because of the way its employment system is structured.”

You talked about this glide path into the state of emergency, what direct impact did this have on Tokyo’s economy?

It’s fairly straightforward in that this will be a very deep recession. The economy is basically running at 60 or 70 percent of its capacity. All the car factories, for example, are being shut down, so a decline in GDP of around 30 to 35 percent is very likely. You are also going to see basically a doubling of the unemployment rate. Unemployment rising from the current two to 2.5 percent to about five percent. In the United States, for example, the severity of the downturn is likely to be much harsher.

In the United States, most experts are forecasting the unemployment rate to go to 25 to 30 percent. It will be a very severe impact. But Japan is in a good position because of the way its employment system is structured. Just to give you some numbers, small- to medium-sized companies basically make up 80 percent of employment in both the US and Japan. In the US a small company has cash reserves typically of 12 to 14 days. In Japan a small company has cash reserves of basically between 25 and 30 days. Effectively, you were able to make payroll in March, April started to be tough, and May is going to be very tough. That is the window that you are running at.

PM Abe announced a stimulus package of ¥108 trillion – 20 percent of Japan’s GDP – to support struggling households and businesses. What effect will this have on Japan’s economy?

Numbers-wise there is still some uncertainty because some of the details are still being worked out. Basically, the first half is designed to counter the income and cash flow problems of Japanese consumers and of Japanese small businesses. The second part is still a work in progress, but it is designed to act as an accelerator for when the economy starts to open up. I think this is a very good policy because we all talk about how we need to digitalize more, we need to focus more on work from home, on education from home, and so on. The second part of the package will create carrots, will create incentives for businesses to restructure themselves.

Japan’s tourism industry is taking a hit, with March 2020 recording 94 percent less foreign visitors than the prior year. And you mentioned the car industry. What other Japanese industries are going to be hit hard?

This is a huge wake-up call to the fact that a lot of Japan is still very low-tech. You have seen the statistics. Barely 10 percent of the country’s companies have the ability to do telecommuting. This is a huge wake-up call that the digital divide is actually huge.

What effect does the postponement of the Olympics have on Tokyo’s economy?

“In a ¥560 trillion economy, I am sorry, that is a rounding error”

There is obviously an immediate loss, but in the overall scheme of things, even if you take the large estimates, which is a trillion yen of lost revenues, in a ¥560 trillion economy, I am sorry, that is a rounding error. The loss of car exports alone is about 20 times larger than the loss that is incurred because the Olympics doesn’t happen in 2020. It’s not really the issue. The bigger issue is that it was something to look forward to. The Olympics were going to be the showcase of Japan being the lifestyle superpower of the world in the 21st century. We’ve got all the hardware. We’ve got the shinkansen. We’ve got the great facilities. We’ve got the fantastic restaurants, but what we also have is the soft power. We’ve got omotenashi. We’ve got capitalism with a smile. That, unfortunately, has been postponed for 2021.

Overall, are you optimistic about Japan’s economic future?

I am extremely optimistic. Japan will always be moderate and slow in its initial response, but you go back through history, every crisis, Japan has emerged stronger, more competitive and more innovative than before. It’s a huge challenge we are facing right now. We are all stuck in the middle and it is easy to despair, but Japan shines when challenged.